Commence with gratitude to the Ultimate Knower, for the Knowledge and ability to share!

- Close your positions, within first 45 to 60 minutes of the gap opening.

- Rule to Close the Position: The moment, two or more bars appear in the opposite direction of your trade. Trade must be closed instantly. What bars should you be monitoring? 4 minutes bars or candlestick (if that option is not available, then 5 minutes candlesticks)

- For option trades (with gap), best time to close your trades: As soon as possible after the gap. Because the volatility jumps through the roof, and so does the option premium. In fact probably the best price of the day for the option shall be offered during the first few bars of the opening of the gap or refer to the rule no. 2 stated herein above.

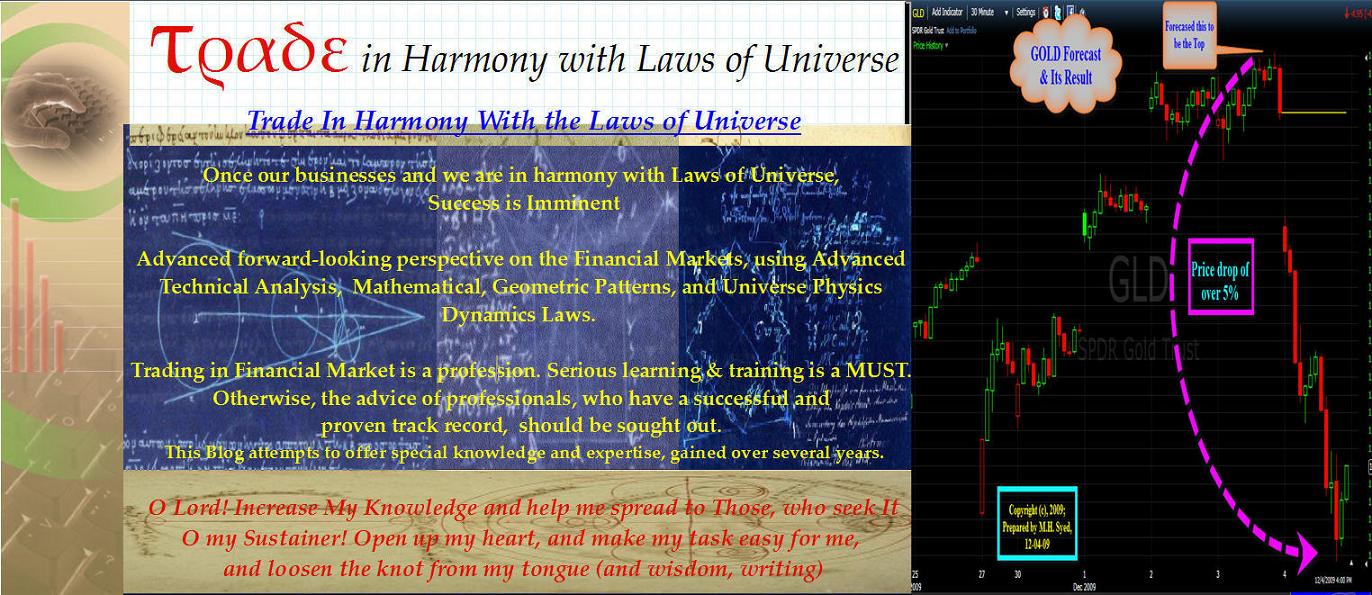

In the example of the attached graph. (click on the charts to enlarge)

1) After the gap, watch for at least first 3 price bars. A shooting star doji, appears, that shows tha price canot go higher.

2) Prices started tumbling down again and reached to fib. level from previous and recent price swing.

3) This Fib. levels is confluent with prior price support. Price had expanded to the 1.382 and 1.272 retracement of the recent price swing.

3) This Fib. levels is confluent with prior price support. Price had expanded to the 1.382 and 1.272 retracement of the recent price swing.

4) 10:20 AM. Last bar is an exhaustion bar, with higher volume, and forms a doji.

5) 10:25. Next bar is long kicker bullish candlestick.

6) It is 9th bar from the recent swing after gap and 14th bar from high price of yesterday (Fibonacci numbers 8, and 13).

7)This bar appears right in the time zone of reversal, which is 60 minutes from the gap open (see the rules above).

8)Volume spikes at the exhaustion bar. Last of the sellers, and buyers come in.

http://trade-in-harmony.blogspot.com/

Bessssst article on how to trade the gap. Thank you for giving out and sharing your trading secrets and techniques.