I commence with my humblest gratitude to The Most Benevolent, The Ultimate All-Knower

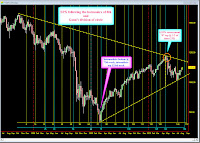

Since May 2010, Markets have gone up, down several times and every time, testing lows and highs made after the May sever and waterfall decline. One of my other posts, titled “Expect the Unexpected”. Well the expected and unexpected (potential) paths of the markets are not that unexpected. We are looking at 4 possible scenarios. 4th one shall be more painful, as it shall drive the market and market participants crazier than one can imagine.

Let us discuss the first 3 case scenarios:

Let us discuss the first 3 case scenarios:For scenario 3, it shall be easy to determine. When the markets trade and close above the down-trend-line on monthly basis, then we know that we have a new bull markets on our hand, just like 1982, 1988 and 1992.

For scenario 1 (and 2), we look at another indicator, which is called Institutional Index. The Institutional Index is a capitalization-weighted index of 75 stocks most widely held as equity investments among institutional equity portfolios. The index is designed to reflect the performance of their core stockholdings. The XII was developed with a base value of 125 as of June 24, 1986. We know that it is the institutions, big money funds, who drive the markets. Therefore, it is a true representation of the market participants. XII retraced 61.8% and made a lower high in 2007. Thereafter it suffered serious decline and made a lower low in March 2009. We see it rallied and retraced only 50% (less strength than last rally attempt) and make a lower high in March/April 2010. Then next obvious move is the continuation of the down-trend.

For scenario 1 (and 2), we look at another indicator, which is called Institutional Index. The Institutional Index is a capitalization-weighted index of 75 stocks most widely held as equity investments among institutional equity portfolios. The index is designed to reflect the performance of their core stockholdings. The XII was developed with a base value of 125 as of June 24, 1986. We know that it is the institutions, big money funds, who drive the markets. Therefore, it is a true representation of the market participants. XII retraced 61.8% and made a lower high in 2007. Thereafter it suffered serious decline and made a lower low in March 2009. We see it rallied and retraced only 50% (less strength than last rally attempt) and make a lower high in March/April 2010. Then next obvious move is the continuation of the down-trend.Now looking at a bit micro level, we look at the weekly chart of the market. We see that markets have been following a mathematical and geometrical pattern, as alluded to my previous posts (it is one of the time cycles markets follow). Based upon this, we have run over the time cycle, for a over-due decline (and still staying within all these scenarios).

THE MOST ACCURATE FORECASTING OF FINANCIAL MARKETS

http://trade-in-harmony.blogspot.com/

Hi Mr.Syed,

thanks for the update. I noticed that you mentioned 'overdue' in your blog and i totally agree based on astrological factors. Can you, if possible, explain why the downturn is overdue? i don't think anyone i know has a fair explanation. The only thing that comes to my mind is that the markets are being manipulated. After the dismal jobs report last Friday, the markets still rebounded off their intra-day lows which is astonishing.

Also, did you get a chance to look at NFLX? 🙂

thanks.

Patrick.

Dear Syed,

This is a great post. I had not looked at the Institutional Index before. I think you are right about your 3 scenarios. I would be intrested to hear what the 4th one is.

Reed